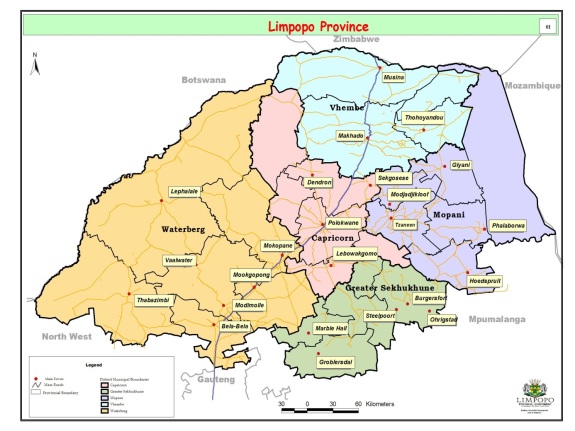

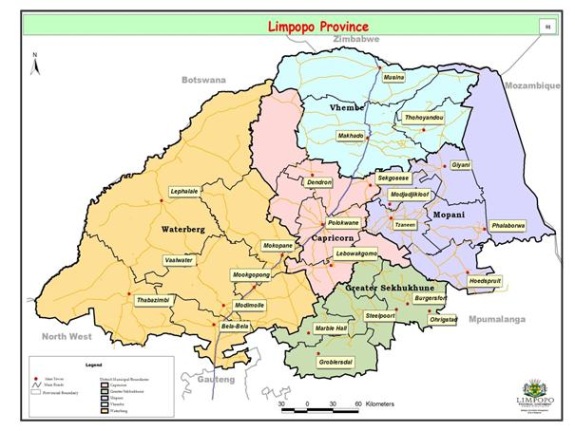

The settlement hierarchy for the province can be described as follows:

- The province has a total of 79 settlement clusters falling within 1st to the 3rd order settlements;

- There are 10 critical highest growing municipalities: (Polokwane, Greater Tubatse, Mahuduthamaga, Lephalale, Makhado, Elias Motsoaledi,Thabazimbi, Mogalakwena, Greater Tzaneen, Ba-Phalaborwa)

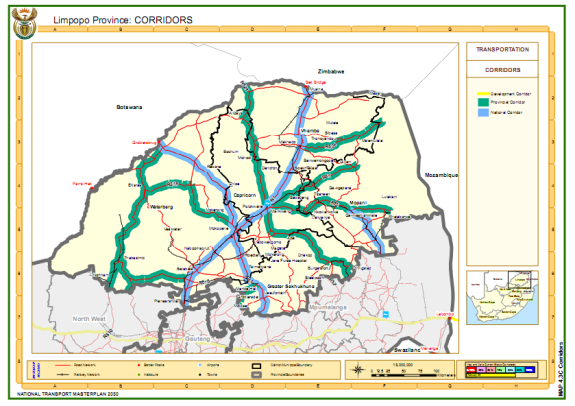

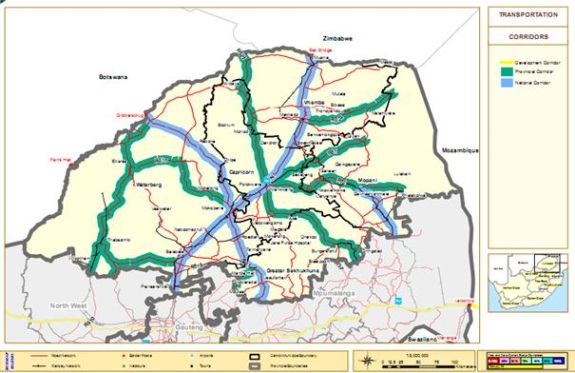

The province has the following corridors as priority corridors:

- Dilokong Corridor- There are three important roads along this corridor within the Capricorn District Municipal area namely Polokwane to Burgersfort (P33/1 and P33/2), via Mafefe, Flag Boshielo Dam through Lebowakgomo and Mafefe, linking the Sekhukhune district with the Phalaborwa and Kruger National Park areas. Chuenespoort via Boyne to Mankweng.

- Phalaborwa Corridor- connects Mpumalanga (Hazyview) with Phalaborwa and Tzaneen via smaller towns to the west of the Kruger National Park. The following road sections form part of the corridor. There are two core routes: Route sections P17/3-5, D726, P112/1-3, P43/2, D1308 and P54/1 Road section P146/1 from Klaserie to Blyde River, P116/1 from Hoedspruit to Ohrigstad via the Strijdom Tunnel, and P181/1 from the Oaks to Burgersfort.

- Trans-Limpopo Corridor- connects Polokwane with Musina along the N1 that is a national competency.

- East West Corridor - links Polokwane via Mokopane to Botswana via the Border Posts at either Groblersbrug or Stokpoort. The following road sections are identified: P83/1 from Mokopane to Groblersbrug, D3390 from Polokwane to Gilead, P19/1-2 and P84/1 from Mokopane to Lephalale and Stokpoort.

The biggest challenge for the Province is to provide roads support for these corridors to link up with other provincial roads and also ultimately lead to the border posts including linkage to Maputo Corridor, Richards Bay and other major activity nodes. The principles should also include densification; shortened travel distance and time. Furthermore the economic viability of each corridor development must focus on long-term employment and sustainable development, and to preferably favour local content (labour, materials and equipment) as well as projects that offer long term capital investments with the potential of low operating costs, that is high efficiency long term solutions. Public transport sub-directorate(empowerment and institutional management) assisted taxi operators by showing them the importance of safety and by undertaking a course to implement those skills.

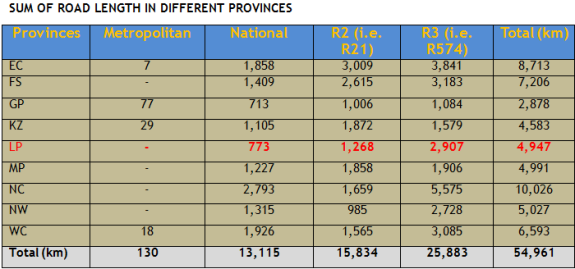

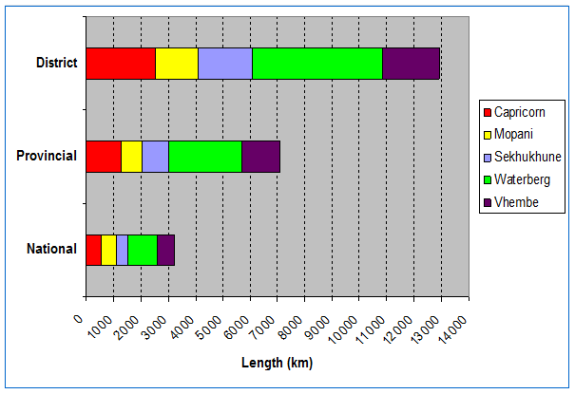

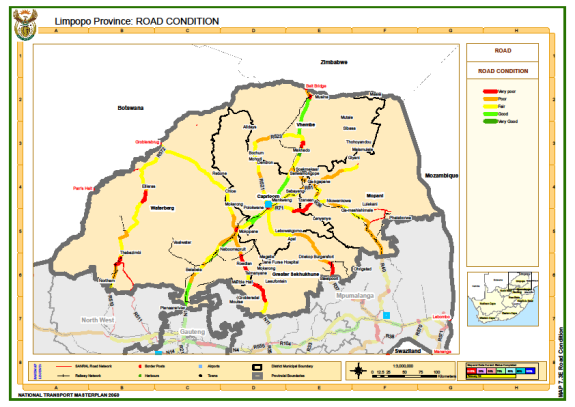

- Limpopo Province has a total road network of about 22 200 km, with 14% of national roads, 33% provincial roads and 53% local roads. An estimated 31% is tarred and the rest is gravel and dirt roads.

- The extent of the national road network is expected to increase significantly in future as some of the provincial roads are planned to be transferred over to the South African National Roads Agency Ltd (SANRAL).

- The total road network in Limpopo represents about 5,0% of the total South African road network which is about 448 000 km excluding streets.

- SANRAL is responsible for a road network of 15 600 km (2.9%) of the total road network in South Africa and 14% of the surfaced network.

- The national roads under SANRAL's jurisdiction comprises of both toll and non-toll roads.

- Less than 10% (only about 310 km) of the SANRAL road network in Limpopo is tolled (the N1 section between the Carousel Plaza and Louis Trichardt).

- SANRAL proposes to extend its road network to approximately 20 000 km.

Sum Of Road Length In Different Provinces

Network length distribution per road owner in Limpopo Province

Ownership of the roads in the Province is as follows:

- National roads, managed by the SA National Roads Agency (Pty) Ltd (SANRAL),

- Provincial roads, managed by the Roads Agency Limpopo (Pty) Ltd (RAL), and

- Local roads (include district roads and streets), managed by the District Municipalities and Local Municipalities. [The district roads are supposed to have been taken over by Municipalities, but they don't have the capacity and therefore the departmental maintenance teams are still maintaining these roads]

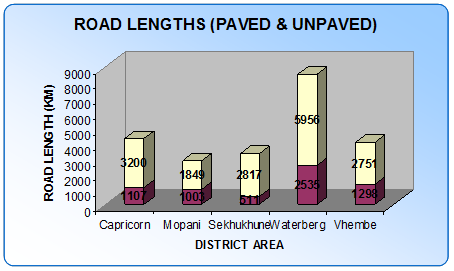

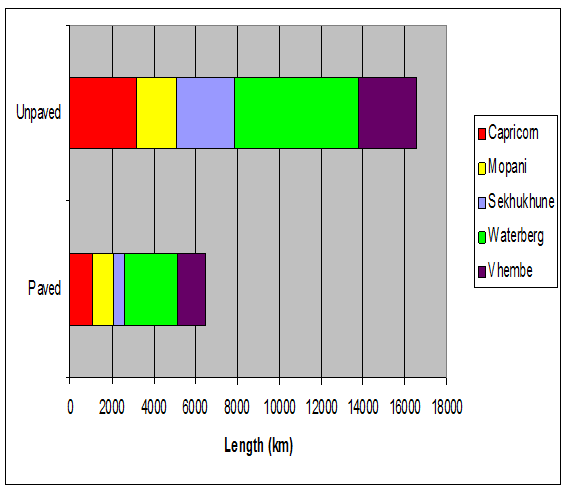

Breakdown of Infrastructure

- 6 780 kilometres of surfaced roads

- 15 219 kilometres of gravel/unpaved roads

- 757 Bridges

- The bulk of unpaved roads are dirt roads which are situated in rural areas

- A need to increase number of kilometres of surfaced roads, to improve accessibility and mobility in the Province

Paved/Unpaved Distribution of Roads in Limpopo Province

- Most roads in the province (almost 8 500 km) are found in the Waterberg District.

- Only 30% (2 535 km) of the roads in the district are paved.

- This level of development is typical across the other four districts in the Province.

- Overall, only 28% (about 6 450 km) of the provincial road network is paved. This represents a typical rural road network profile.

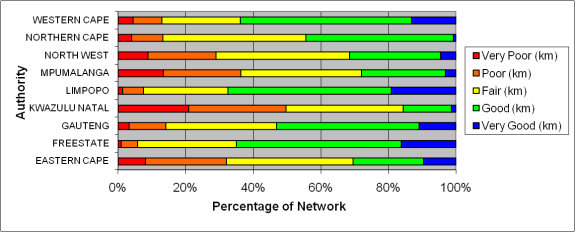

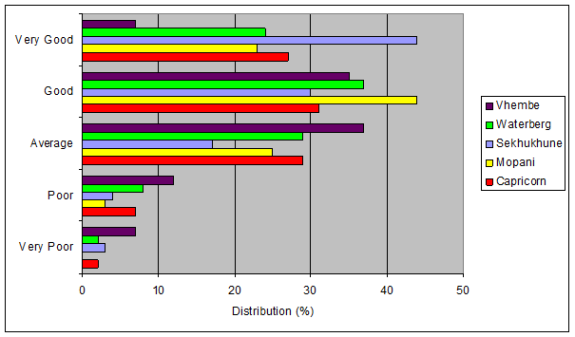

Provincial Paved Road Network Condition

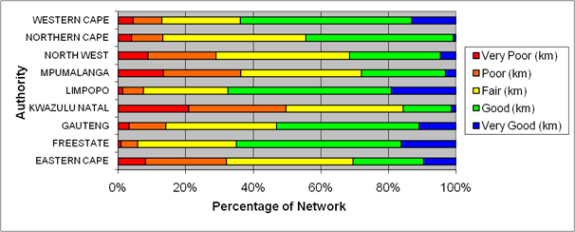

Provincial Gravel Road Condition

Provincial View - Gravel Roads

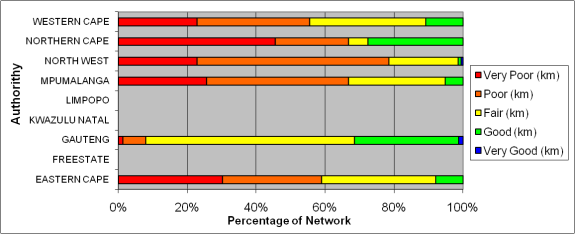

Road Infrastructure by Visual Condition Index

Note: Visual Condition Index Classifications: 10% = Very poor: 30%=Poor: 50%=Average; 70% = Good; 90%=Very Good N/A = Not Available

Road Condition Summary

- Surfaced roads are generally in a good condition, where about 30% of the network is rated as very good and about 36% being rated as good

- Most bridges are in good condition whilst a limited percentage are in a critical to marginal condition and need urgent attention

- The funding for road infrastructure is always insufficient to adequately maintain the road network and provide equitable provision of access

- The LDoRT has the following backlogs in terms of the provisioning of road infrastructure:

- An estimated R4 030 million in maintenance of surfaced roads

- An estimated R 67 billion in upgrading (gravel to surfaced standards)

- An estimated R 206 million in maintenance of bridges

- An estimated R783 million in re-gravelling

- These backlogs have a negative impact in the provisioning and maintenance of the road infrastructure

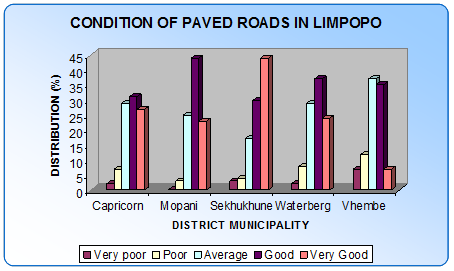

Condition of paved roads in Limpopo

- On average, about 3% of the paved road network is in poor to very poor condition with a further 27% in an average condition, and

- The paved road network in the Sekhukhune District Municipality is in much better condition in comparison with the other districts.

Distribution of Road Condition by District

Road maintenance Cost Centres

- Upgrading of provincial roads is done by the Roads Agency Limpopo

- Road Maintenance is managed by the Department and routine maintenance is dine through 36 cost centres in the Province

- More than 80% of the road maintenance equipment, vehicles and machinery are older than twenty years and need to be replaced

- LDoRT requires an estimated R618 million to replace the equipment that have been written-off or should be written off in terms of the disposal policy.

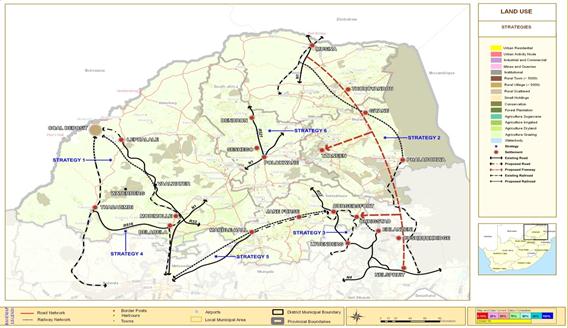

- Strategy 1: Link the Lephalale coal field to the Richards Bay Coal Terminal and the Witbank coal-fired power stations.

- Strategy 2: Create a direct link between the Maputo export harbour and the SADC countries located north of Limpopo, via Giyane and Bushbuckridge.

- Strategy 3: Ensure good access between the Burgersfort platinum mining belt and the Maputo harbour to allow the export of chrome and platinum

- Strategy 4: Ensure good access to the Waterberg Biosphere to unlock the development potential of this Biosphere and establish Bela-Bela as a gateway tourist node.

- Strategy 5: Link Burgersfort and Jane Furse to Tshwane (Gauteng) along the Moloto corridor using alternative modes of transport.

- Strategy 6: Ensure good access between Dendron and Polokwane with a focus on road-based public transport.

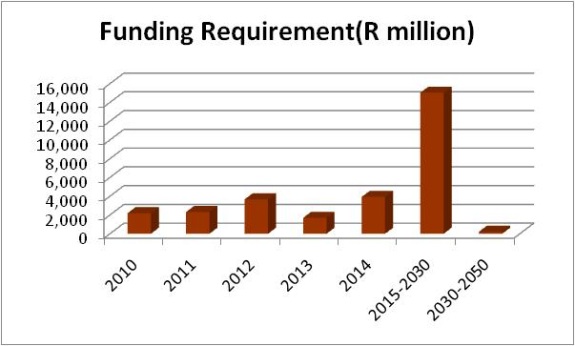

Total Funding Requirement Of All Limpopo Projects (R Million): 29,023

In order to address the freight identified bottlenecks the following projects have been identified for future execution:

National Freight Transport Policy

- Create a National Transport Commission with executive level and academic expertise in freight transport to advise the Minister and broaden the decision making and policy formulation process for freight transport to include the logistics providers and industrial users;

- Critically analyse the role of Department of Transport as the regulatory authority:

- Redefine structures and responsibilities;

- Establish functional departments capable of being the regulatory authorities needed to manage freight transport;

- Commission a professional evaluation of current skills deficiencies in all modes and develop a national framework of privately managed training institutions with appropriate subsidised budget and strategy to attract students.

- Commission research to establish the necessary conditions for creating a sustainable road freight infrastructure funding system;

- Develop effective methods for road user cost recovery, including re-evaluation of toll roads strategies and practicable nation-wide alternatives;

- Commission research into the logistics systems surrounding the major ports and the need for infrastructure planning;

- Complete the analysis of cross-border road freight operations and plan for large scale upgrade of facilities and systems at key border posts.

- Research international systems development and evaluate the potential for attracting investment and involvement in provision of services.

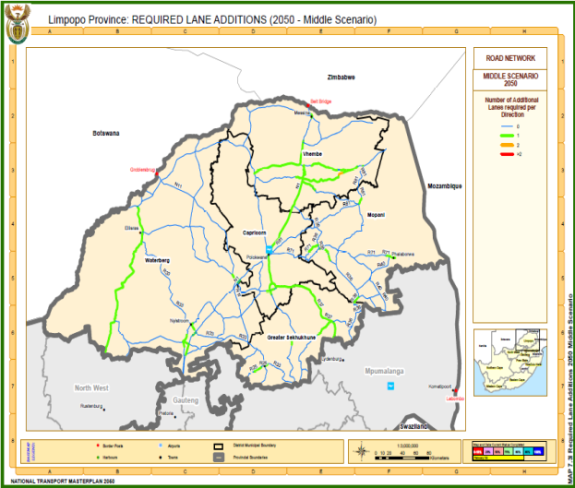

Investigating the required lane additions spatially, the required additional lanes are located in the following areas of the Limpopo Province:

- N1 Section between Makhado and N1/R525 Junction (2005)

- R37 Section between Polokwane and Lebowakgomo (2005)

- R524 Section between Makhado and Thohoyandou - at R523 junction (2005)

- R510 Section between Limpopo/North West Province border and R572 junction (2030)

- N1 Section between R36 junction and Makhado (2030)

- N1 Section between Makhado and R525 junction and at Musina (2030)

- R71 Section between Moria and Tzaneen (2030)

- R37 between Lebowakgomo and Burgersfort (2030)

- N11 Section through Mokopane and at R516 IC (2030)

- R523 Section between R521 and R524 (2050)

- Balance of R524 Section between Makhado and Thohoyandou (2050)

- Local Sections of R36 (Tzaneen); R71 (Phalaborwa); R81 (Giyani) by 2050

- R525 Section in Sekhukhune (2050)

- R33 Section between N1 and Modimolle (2050)

- R101 Section between Gauteng North (Hammanskraal) and Bela-Bela (2050)

- N1 Section between Gauteng North (Caroussel Plaza) and Bela-Bela (2050)

In each of the above 1 x lane required per direction, except a short Section of the R524 Section and R523 junction which would require addition of 2 lanes by 2050.

Map: Required Lane Additions by 2050 (Middle Scenario)

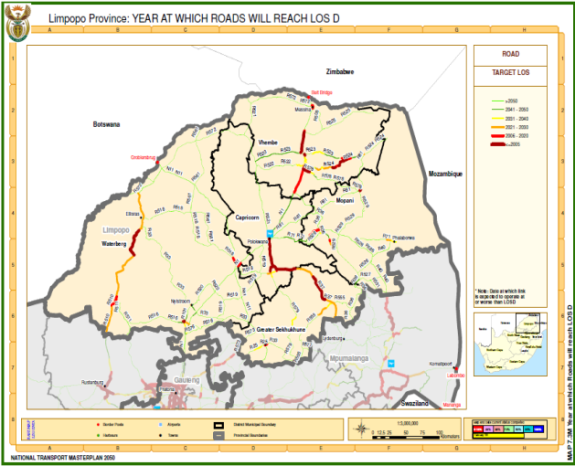

Map: Year at which Roads will reach LOS D

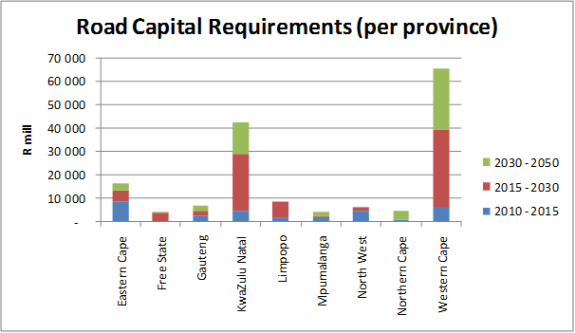

Five Year Development Plan (Short Term): 2010-2015

The five year development plan (short term projects) for Limpopo Province for the period 2010 to 2015 is indicated in the following tables.

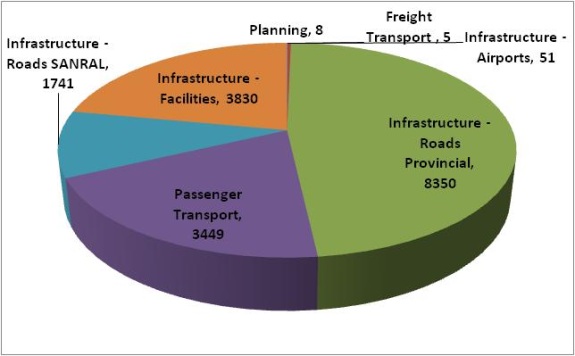

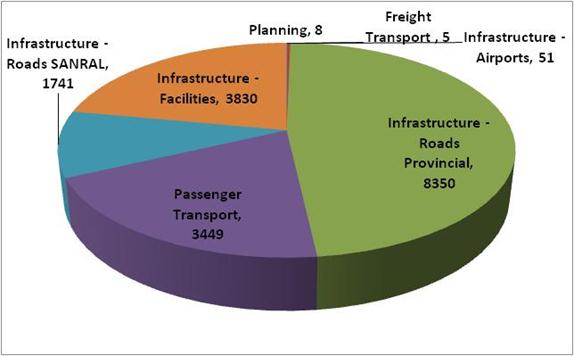

The first order cost estimates per infrastructure category for the five year development plan is indicated in tables that follow. The bulk of the identified projects (in terms of monetary value) relate to road projects (SANRAL and provincial) and passenger transport projects. The estimate total cost of all projects for the period 2010 to 2015 is about R 17,434 million.

Table : Limpopo Five Year Development Plan (Short Term): 2010 - 2015

Goal Achievement Matrix (GAM) scores:

- Scores between 70 and 100 have been highlighted in red;

- Scores between 40 and 70 have been highlighted in green;

- Scores less than 40 have not been highlighted.

Figure: Five Year Development Plan (2010-2015): First Order Cost Estimates per Infrastructure Category (R millions, 2010 values)

Medium Term Development Programme: 2015-2030

The medium term development programme for Limpopo Province for the period 2015 to 2030 is indicated in table that follows.

The first order cost estimates per infrastructure category for the medium term development programme is indicated in above. The bulk of the identified projects (in terms of monetary value) relate to rail passenger projects and rail freight projects. The estimate total cost of all projects for the period 2015 to 2030 is about R 6113 million.

Table: Limpopo Medium Term Development Programme: 2015 - 2030

Goal Achievement Matrix (GAM) scores:

- Scores between 70 and 100 have been highlighted in red;

- Scores between 40 and 70 have been highlighted in green;

- Scores less than 40 have not been highlighted.

Figure: Medium Term Development Programme (2015-2030): First Order Cost Estimates per Infrastructure Category (R millions, 2010 values)

Long Term Development Programme: 2030-2050

The long term development programme for Limpopo Province for the period 2030 to 2050 is indicated in Table that follows.

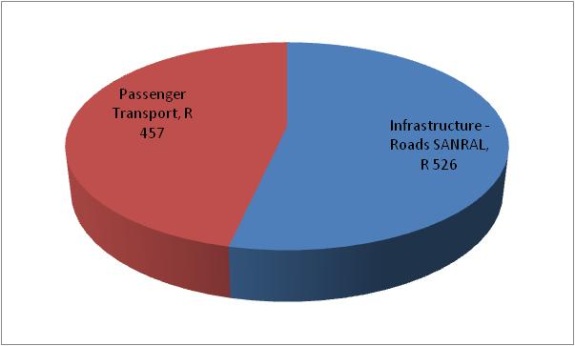

The first order cost estimates per infrastructure category for the long term development programme is indicated in that follows. There are two projects in the long term development programme namely roads and passenger transport category. The estimate total cost of all projects for the period 2030 to 2050 is about R 983 million.

Table: Limpopo Long Term Development Programme: 2030 - 2050

Goal Achievement Matrix (GAM) scores:

- Scores between 70 and 100 have been highlighted in red;

- Scores between 40 and 70 have been highlighted in green;

- Scores less than 40 have not been highlighted.

Figure: Long Term Development Programme (2030-2050): First Order Cost Estimates per Infrastructure Category (R millions, 2010 values)

National Projects Relevant to Limpopo Province: 2010-2050

The national (inter-provincial) projects relevant to Limpopo Province for the period 2010 to 2050 are indicated in Table that follows.

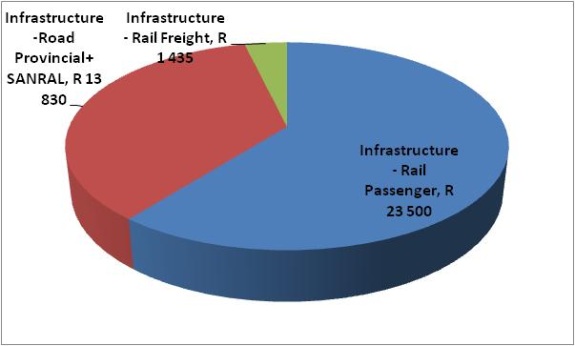

The first order cost estimates per infrastructure category for the national projects indicated in Table 2, is shown in Figure that follows. The bulk of the identified projects (in terms of monetary value) relate to rail passenger. The estimate total cost of all national projects indicated in table that follows is about R 38,765 million.

Table: National Projects Relevant to Limpopo Province: 2010 - 2050

Goal Achievement Matrix (GAM) scores:

- Scores between 70 and 100 have been highlighted in red;

- Scores between 40 and 70 have been highlighted in green;

- Scores less than 40 have not been highlighted.

Figure: National Projects Relevant to Limpopo Province (2010-2050): First Order Cost Estimates per Infrastructure Category (R million, 2010 values)

Critical Projects

A total of five critical projects have been identified for Limpopo, namely the following:

- Develop a regional passenger rail system: Moloto Corridor;

- Pretoria-Polokwane High Speed rail

- Feasibility Determination for & Project Management Of The Development of a Multi-Modal Logistics Hub in Polokwane & a One-Stop Border Facility in Musina /Martins Drift(Groblersburg)

- Pre-Feasibility Determination of Aero-city concept, ICC and Reposition of PIA

- Construction of the R33 between N1 intersection through Modimolle to Lephalale to improve development of East-west corridor

- Conceptual planning of a commuter service between Mokopane and Polokwane

TABLE: Summary of Institutional Projects Identified for Implementation

TABLE: Summary of Legal Projects Identified for Implementation

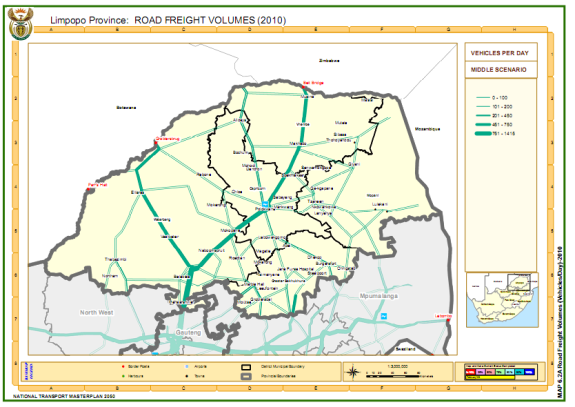

Road freight volumes in Limpopo are expected to change over time, with major corridors handling increased general cargo and some reduction in the localised transportation of coal.

In the Map below, the current situation (2010) is shown for the major national and provincial routes. As shown, most of the provincial routes handled tonnages below 1 million tonnes per annum. The N1 from Gauteng to Musina (and Beit Bridge) handles approximately 9.8 million tonnes per annum and the N11 to the Botswana border handles about 2.2 million tonnes p.a.

Map: Road Freight Volumes (tonnes/day) (2010) (Middle Scenario)

The Map below shows the anticipated growth in road freight traffic to 2030 and it can be seen that the demand for road freight on the N11 is expected to increase over the period. The N1 route between Gauteng and Beit Bridge is also anticipated to experience increased traffic depending on the recovery of the Zimbabwe economy.

Map: Road Freight Volumes (tonnes/day) (2030) (Middle Scenario)

In the Map below, road freight volumes to 2050 indicate an anticipated significant increase in the amount of road traffic on the N11 corridor between the Limpopo coal mining areas and Gauteng. On the N1 corridor between Gauteng and Musina (and Beit Bridge) further increase is expected but that will depend on the economic growth in neighbour states to the north. It can also be anticipated that there will be increased tonnage on the southern sections of the corridor as power generation and coal mining are expanded into Limpopo.

Map: Road Freight Volumes (tonnes/day) (2050) (Middle Scenario)

Road

Operational CapacityThe future operational capacity of road freight transport is largely unlimited, over most of the road network for the period under review. There are however specific areas of infrastructure under-capacity around the major urban and industrial areas that are in need of urgent upgrading as described in the infrastructure chapter of this report.

Infrastructure RestrictionsFrom an operational perspective, the infrastructure constraints result in congestion, lack of efficiency, accidents, pollution and general restriction of the ability of the road freight mode to deliver efficiently and cost effectively.

ExternalitiesThe externalities created by road freight transport, are in need of urgent attention, as the capacity to move tonnage must be accompanied by the capacity to limit externalities such as accidents, road damage, pollution, road safety (speeding, driving hours, load securement) and the transport of hazardous goods with all due safety precautions.

Operator QualityThe capacity of road freight transport operators to operate efficiently, safely and within the standards for externalities defined in the legislation, requires specific level of training experience and managerial ability. Failure to provide for the efficient management of freight transport (as with other modes of transport) inevitably leads to inefficiency and an increasingly negative impact from the externalities of the mode.

There is urgent need for revision of the road freight transport operator licensing system to introduce an element of responsibility, competence, registration, and control to reduce the future impacts of the inevitable growth in road freight transport.

Enforcement CapabilityThe quality standards of the road mode in South Africa are ineffectively regulated due to lack of capacity by the enforcement authorities, hampered by failure to introduce an effective regulatory system that will permit offenders to be constrained and controlled.

Fuel ShortagesThere is anticipation that when the world economy recovers from the present recession there will again be pressure on the supply of carbon based liquid fuels that are the essential power source for current road freight vehicles. The increasing cost of diesel fuel will place severe pressure on users of road haulage and in the absence of alternative electrified rail services; the cost of long haul freight transport may severely limit industrial growth potential.

Intermodal

The future constraints on intermodal transport in South Africa are considered to be a function of the institutional framework. The development of truly intermodal competitive cargo services depends on the ability to negotiate open competitive procedures and the introduction of modern equipment.

It is expected that private sector operators will be unlikely to invest in intermodal services as long as they are faced by a monopoly partner with the current powers accorded to the national transport operator. This limitation on private investment in intermodal transport means that the road and rail sectors will continue to operate in isolation, in competition, without any attempts at developing what could be effective intermodal services.

There is need for an urgent review as this is a priority, in relation to the total future logistics systems development in South Africa.

Road maintenance should be a critical step in the sustainable management of road infrastructure in our country. Road maintenance has to ensure easy accessibility to and within the Province and also be the conduit to socio-economic activities that involve the quality of life for all residents.

Maintenance StrategyRoad pavement preservation requires identification of pavements sections that will most benefit from the treatment rather than the section in the worst condition. The Pavement Management System (PMS) maintenance optimisation routine is based on the benefit cost where the life cycle sots and the annual deterioration are taken into account.

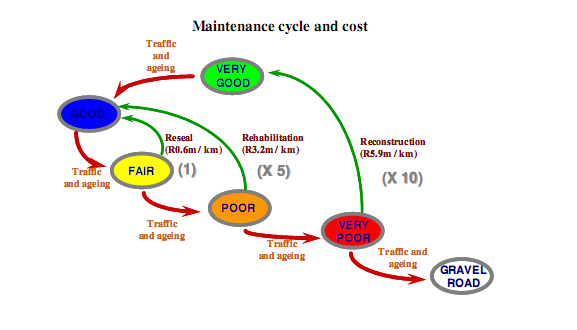

As the graph below illustrates, it is very important to do the right maintenance at the right time. Any delay in the maintenance causes further road deterioration and escalates the cost. Economic analyses show that preventative maintenance (e.g. resurfacing, rejuvenation) is five to ten times more cost effective than reactive maintenance (e.g. rehabilitation).

Decline of Secondary Road Network

The infrastructure analysis executed for the roads of national importance in Limpopo at the Phase 2 stage, revealed that the road network is generally in fair condition (sound to warning condition). Financial constraints, especially in the past, have lead to a backlog of about R2,5 billion in the maintenance, renewal and upgrading of the road network in Limpopo. Over the past few financial years, the allocation of funds to roads has improved greatly. This has led to the current position, where at least the decline in paved road condition has been halted, though not yet reversed.

Identification of Bottlenecks

The following bottlenecks, where 95% of capacity is exceeded, have been identified:

By 2030 the following bottlenecks can be expected:

- Lephalale - Thabazimbi

By 2050 to following additional bottlenecks can be expected:

- Thabazimbi - Chromedale

- Chromedale - Tussenin

- Tussenin - Northam

- Northam - Boshoek

Transnet, with the current responsibility to manage capacity on the rail network, has developed a dynamic model taking into account desired market shares for the transportation of different commodities; taking into account routing alternatives, operational alternatives, etc. to come to their own future capacity utilisation results

By 2030 Transnet expects the following additional bottlenecks:

- Phalaborwa - Hoedspruit

By 2050 Transnet expects the following additional bottlenecks:

- Musina - Louis Trichardt

- Louis Trichardt - Groenbult

- Modimolle - Bela-Bela

- Pienaarsrivier - Hammanskraal

- Hoedspruit - Kaapmuiden

- Steelpoort - Belfast

A number of interventions are possible to improve capacity, which includes inter alia the following:

- Once 80% of capacity is exceeded operational redesign is essential with limited infrastructure upgrades.

- Once 95% of capacity is exceeded operational redesign lines are reached and infrastructure upgrades are required.

- Once 105% of capacity is exceeded new infrastructure and new operational plans are needed.

- Once 130% of capacity is exceeded significant infrastructure improvements are required which include possible doubling of lines or new lines.

Because of its characteristics, rail freight transport is most suited to:

- Commodities which can be transported in bulk between origin and destination.

- Commodities with safety implications can also be considered is some cases to be more relevant to rail.

In considering possible modal shifts from road to rail consideration should be given to commodities that fit the characteristics of rail and the market expectations of the client.

It is the opinion that a modal shift to rail makes sense in cases where there is road capacity pressures at the same time when rail has spare capacity. A modal shift strategy to rail could make sense under certain circumstances and need to be applied responsibly in order to ensure that the interest of the economy is served in the most cost effective way.

The low utilisation of a few lines in the province provides opportunities for modal shifts from road to rail. The Musina to Pienaarsrivier line is underutilised and could benefit from additional traffic.

Addition of Links / Expansion of Network

Once the previously mentioned strategies have all been exhausted to improve the capacity situation the means of last resort is the addition of rail links and the expansion of the network. With the current extensive rail network that covers all important harbours and link most major centers this should be the exception rather than the rule.

Network extensions could serve one of two purposes:

- Provide additional points of accessibility to the existing extensive network.

- Provide additional routes of connectivity that could save time and money to the users and provide a shorter route between harbours and hubs.

Transnet already identified a number of additional links to make the rail freight network more accessible to the current needs of the economy. Most additional links are need-specific to improve connectivity to major facilities like City Deep and to new mining operations like in the case of mines in the vicinity of Lepalahle Limpopo.

Network expansions with new routes/corridors are only considered once additional capacity cannot be provided within the boundaries of the existing network. If the cost of capacity improvements to the existing freight network is to high and due to technology restrictions not desirable at all cost, consideration can be given to network extension.

A specific instance that could require consideration in terms of a new route/corridor is the one between Gauteng and harbours on the east coast (Durban/Richards Bay). It the additional capacity required on the two existing major corridors to Bayhead Durban and Richards Bay respectively both require extensive investment the introduction of a third new route could become financially attractive.

A number of line extensions have been identified in this province to serve new mining activity in the Lephalale area. They are the following:

- Lephalale - Mahalapye

- Vaalwater - Matlabas

Identification of Critical Projects

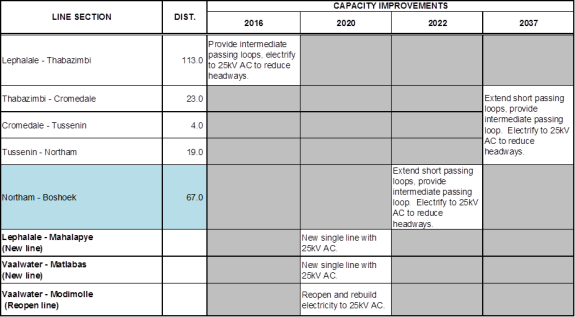

In terms of the Transnet planning approach a number of identified infrastructure related project for the relevant sections have been identified and is contained in the table below. Transnet also indicates the year in which the identified infrastructure has to be available according to their current freight projections

In order to address the identified bottlenecks the following projects are identified for future execution:

Before 2030:

Lephalale Link:

- Lephalale - Thabazimbi line upgrade

- Thabazimbi - Northam line upgrade

- Northam - Boshoek line upgrade

Extensions to Lephalale Link:

- Vaalwater - Modimolle rebuild and reopen line

- Vaalwater - Matlabas new freight line

- Lephalale - Mahalapye new freight line

Table: Transnet Proposed Infrastructure Improvements to the Core Freight Rail Network to Improve Capacity

Note: Prepared from information sourced from Transnet Freight Rail

Intermodal Facilities

Summary of Existing Intermodal Facilities of National Importance

Freight Inter-Modal Facilities

- Tzaneen

- Lephalale

- Burgersfort

Future Need for Inter-Modal Facilities of National Importance

Freight Inter-Modal Facilities

- Multi-Modal Logistics Hub In Polokwane

- One-Stop Border Facility in Musina /Martins Drift(Groblersburg)

Current Planning - Evaluation of Strategy

The table below presents summary details of the identified public transport infrastructure projects.

Table: Limpopo Department of Roads and Transport - Multi-Year Transport Infrastructure Projects 2009/2015

Source: Limpopo Department of Roads and Transport

Copyright © 2012 Limpopo Province Freight Transport Data Bank | Developed and Powered by Safiri South Africa.